In September 2012, “QE3” (short for “Quantitative Easing 3” or “Quantitative Easing, Round 3”) was announced by U.S. Federal Reserve Chairman Ben Bernanke. (It wasn’t called that in his speech, but that’s what it is.)

For the lay person, this is the third time “the practice of increasing the supply of money in order to stimulate economic activity” has been done under President Obama. (Another QE definition that goes into more detail is in the description of this video.)

For the lay person, this is the third time “the practice of increasing the supply of money in order to stimulate economic activity” has been done under President Obama. (Another QE definition that goes into more detail is in the description of this video.)

Before we delve into how this monetary policy affects professional truck drivers, we must issue the disclaimer that we are neither economists nor certified financial planners.

However, we read articles, watch videos and listen to interviews from those who understand monetary policy, are able to interpret it in plain language and who favor the free market.

Some of these folks have been watching the financial markets for a very long time and they see trouble on the American horizon.

Since our website is about helping truckers save money, we feel that it is our duty to pass along some of these things to you.

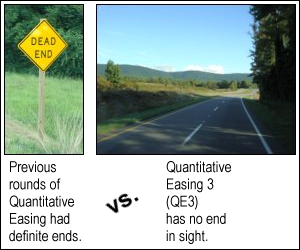

Comparing Rounds of Quantitative Easing

There have been a variety of monetary policies that have taken place,

There have been a variety of monetary policies that have taken place,

– whether called a “bailout” under President George W. Bush.

– or called a “stimulus” under President Obama.

Those had definite ends.

What is striking about the QE3 announcement is that it is open-ended.

The Federal Reserve has taken it upon itself to inflate the money supply endlessly — without having a solid standard to back it up.

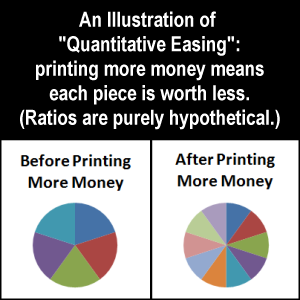

When more money is printed, the “value” of the currency in circulation goes down.

Inflating the Monetary Base

The Federal Reserve Bank of St. Louis has economic research on its website (Federal Reserve Economic Data, or FRED®).

The Federal Reserve Bank of St. Louis has economic research on its website (Federal Reserve Economic Data, or FRED®).

This page has a graph that shows the St. Louis Adjusted Monetary Base (BASE).

You can see for yourself the huge spike in the money supply in recent years.

We liken expanding the monetary base to blowing up a balloon.

Everyone knows that there is a limit to how big a balloon will get and how much air it will hold.

It will stretch only so far before it bursts.

Will QE3 and its endless inflation of the monetary base destroy it?

A September 18, 2012 article from Forbes.com has a graph that shows how the price of gold has surged with the increase of the U.S. monetary base.

If you search online, you will find that many people consider gold to be a wealth protector.

If the price of gold goes up, that means that the value of the dollar went down.

We reported previously on our investment advice page about the amount of inflation we have had in the USA since 1913, the year the Federal Reserve was created.

One can calculate inflation on the BLS’s CPI Inflation Calculator.

According to the calculator, the buying power of one dollar ($1.00) is only $0.04 (compared to 1913).

This means that 96% of the buying power has been destroyed.

According to John Williams (of ShadowStats.com), 98% of the buying power of the dollar has been destroyed.

youtube.com/watch?feature=player_embedded&v=XSreavGR4vE#%21 (no longer online)

We (and others) interpret QE3 to mean that the Federal Reserve is bent on destroying what little is left of the value of the paper dollars (Federal Reserve Notes).

It will take more of the paper dollars to buy goods and services that we buy.

This is inflation.

Inflation is the Start

You may be familiar with the collage we have on our home page of saving and growing money:

One definition of inflation is: “A general increase in prices and fall in the purchasing value of money.”

That’s what we’ve been facing.

We’ve created another collage to show the effect of inflation or deteriorating value of money:

When you have “monetary inflation occurring at a very high rate,” that’s hyperinflation.

There have been hyperinflations in the past.

On September 19, 2012, Gary North referred to an article on the worst 56 hyperinflations (found here).

On page 13 of that document, you will find “The Hyperinflation Table” with some truly frightening information.

Folks like us have heard about Zimbabwe’s hyperinflation.

But until seeing this table, we didn’t know that they had, among other things:

- Equivalent Daily Inflation Rate: 98.0%; and

- Time Required for Prices to Double: 24.7 hours.

Are Americans and American truckers facing something as bad as this with QE3?

We don’t know.

We hope not.

But the USA is trillions of dollars in debt and we think that truckers will be adversely affected.

Will truckers outside the USA be affected by QE3?

If truckers in the USA are affected, most likely truckers elsewhere will be affected too, although maybe not so much.

It depends on the stability of their currency.

Mr. North (among others) sees QE3 as leading to hyperinflation in the USA and eventually the U.S. government defaulting.

Personal Savings Rate, Net Worth and Income Drop

If QE3 leads to greater and greater amounts of inflation, it will be harder and harder to save money.

We’re already seeing how hard it is for some people.

One website defines Personal Savings Rate as “the fraction of personal income that is not consumed.”

One website used to define it as “Savings as a percentage of the population’s average disposable income.”(1)

YCharts.com has data and a chart showing the U.S. Personal Saving Rate.

As of this writing, it was 4.2% for July.

A June 12, 2012 article from CNN Money states:

A June 12, 2012 article from CNN Money states:

The average American family’s net worth dropped almost 40% between 2007 and 2010, according to a triennial study released Monday by the Federal Reserve.

The stunning drop in median net worth — from $126,400 in 2007 to $77,300 in 2010 — indicates that the recession wiped away 18 years of savings and investment by families.

Many other documented numbers about the economy are compiled and updated by Michael Snyder.

For your convenience, we are linking to some of his compilations:

- The U.S. Economy By The Numbers: 70 Facts That Barack Obama Does Not Want You To See;

- Things Are Getting Worse: Median Household Income Has Fallen 4 Years In A Row;

- QE3: Helicopter Ben Bernanke Unleashes An All-Out Attack On The U.S. Dollar;

- How QE3 Will Make The Wealthy Even Wealthier While Causing Living Standards To Fall For The Rest Of Us; and

- The Federal Reserve Is Systematically Destroying Social Security And The Retirement Plans Of Millions Of Americans.

How Will Truckers Be Affected by QE3?

QE3 will affect nearly all Americans.

Some will be able to weather the storm better than others.

Unfortunately because of your mobile occupation, you as a professional truck driver may have a particularly hard time — especially if you’re away from your home base for days, weeks or months at a time.

Depending on whose information you read (or where your imagination leads), QE3’s inflation could give rise to such things as poverty, food shortages, desperation, civil unrest, looting and rioting, violence, bloodshed, martial law, arrests, etc.

QE3 and Food

Everybody has to eat. Will QE3 affect food? Yes — especially those who are dependent on the government for it.

As of June 2012 (the last month for which figures were available as of September 2012),

As of June 2012 (the last month for which figures were available as of September 2012),

- the number of Americans on food stamps was 46,670,373,

- with over 22.4 million households receiving them.

Scott Lazarowitz penned an article in which he wrote:

… Eventually the austerity measures we have been seeing in Europe will reach the U.S.

Austerity measures will hit public employee benefits and pensions, and welfare and Medicare recipients …

…

Now, regarding eventual shortages, austerity and civil unrest in America that would involve the unavailability of Electronic Benefit Transfer (EBT) payments, in large part affecting food stamp recipients, one scenario I’ve seen details how rioting and turmoil could unfold, mainly beginning in the cities, but eventually flowing out into the suburbs. It is not a pretty picture.

One would think that the government bureaucrats who control these social programs could see ahead what would happen when withholding such benefits, especially with millions of people dependent on them for their daily sustenance. So, in the case of possible future EBT cards not functioning followed by rioting and violence, one has to wonder whether such an action by the government could be purposeful.

…

… How will Americans, in their cars stuck in busy intersections when flash mobs rampage and attack them, be able to defend themselves if they have been disarmed by the government? When looters and burglars break into their homes and businesses, how will disarmed homeowners and businesspeople protect themselves?

…

When People Get Hungry

When people get hungry, they do crazy things.

We hate to do so, but we predict that the time may come when professional truck drivers — especially those who haul refrigerated vans filled with refrigerated or frozen food — will become targeted by hungry people.

Of course, when hyperinflation from QE3 (and many other government actions leading up to it) kicks in, any trucker hauling anything may be targeted.

What Can You Do? How Can We Help?

We have already attempted to help you prepare by writing about such things as

- having a budget;

- setting goals;

- getting rid of credit card debt;

- not having to rely on foreign ATMs for cash;

- taking advantage of trucker rewards programs (loyalty programs);

- not depending on cash advances to meet your needs;

- setting up an emergency fund;

- using sales tax holidays to your advantage;

- preparing and cooking food in your truck;

- having a first aid kit assembled;

- having an emergency kit ready to go;

- having your medical emergency information up to date; and

- protecting yourself with adequate in-truck home security and appropriate self defense.

Based on the information in these YouTube videos (link and link) decide for yourself if holding your wealth in the form of U.S. dollars — if the “value” of those dollars continue to decline — is what you want to do.

Based on the information in these YouTube videos (link and link) decide for yourself if holding your wealth in the form of U.S. dollars — if the “value” of those dollars continue to decline — is what you want to do.

You may want to consider other types of investments.

![]() Money saving tip: Get out of debt — now.

Money saving tip: Get out of debt — now.

For you owner-operators who do not yet own your own truck, if you are thoroughly convinced that paying for a truck that you do not yet own is still the best way to go, do everything in your power to get the truck paid off as quickly as possible.

According to the Bureau of Labor Statistics, Heavy and Tractor-trailer Truck Drivers earn:

- 2012 Median Pay;

- $38,200 per year

- $18.37 per hour

Another source of wage info Occupational Employment and Wages: 53-3032 Heavy and Tractor-Trailer Truck Drivers.

Find or create a second income that you can do during your off time. (Make sure you get adequate sleep so you can drive without being sleepy!)

Work to build that income source so that you can lean back on it during hard times — or in the event that you are forced to retire from the trucking industry.

If you have the money to do so, you may wish to investigate the possibility of investing in “hard goods” that will have a better yield than other investments.

We read an inspiring true account of a 14-year-old girl (yes, only 14 years old!) whose entrepreneurial spirit led her to find a source of income that she saved that enabled her — together with her mother — to buy a home that she is now renting out. Now that’s creativity!

If you have a home support team back home and your home is large enough to do so, consider renting out part of your space.

We have done this in our dream come true.

Return from QE3 or Quantitative Easing 3: What Does It Mean for Truckers? to our Budgeting page or our Truck Drivers Money Saving Tips home page.

References:

1. www.businessdictionary.com/definition/personal-savings-rate/ (no longer online)