Vicki will never forget the day when Mike got “credit card statement shock.”

As the person in our home who routinely pays the bills, he was getting ready to write a check to pay toward what had become an out-of-control account when he discovered that the amount he was preparing to send wouldn’t even cover the interest due that month!

As a bit of background, Vicki had gone through a Biblically-based financial freedom seminar some years before and vowed not to get into debt.

But that was years before she met Mike and he had not had the benefit of that training.

So, when things got a bit tight financially, he started to put our expenses “on plastic.”

Some Day The Bill Comes Due

The problem with living on credit is that some day, the bill comes due.

Vicki had prayed for Mike for months to be able to “see” what he was doing.

Finally, that day, he did.

Mike realized that every bit of money showing in interest on our credit card statement was money that wasn’t being invested in appreciating assets.

Mike realized that every bit of money showing in interest on our credit card statement was money that wasn’t being invested in appreciating assets.

He promised that from that day forward, he would work to pay off the debt and never get in that situation again.

Having been through truck driver training school and gotten experience as a professional driver, he knew that his best option for paying off the debt as fast as possible was to get a truck driving job, which he did.

It took over a year to make it happen, but after pulling in our financial belt very tightly, that whopping debt was finally paid off.

Hurray! The credit card statement showed that we didn’t owe anything any more!

We encourage every professional truck driver to faithfully pay off all of the revolving credit he or she owes and to never again pay interest.

This also holds true for drivers making truck payments; the sooner an owner-operator can be debt-free, the sooner he/she can start saving more money.

The Move from Payer to Payee

Following becoming debt-free, we took a many-years-long “fast” from using credit cards at all.

Then, Mike slowly began to use credit again, particularly using one card through which we could earn cash back bonus rewards.

Of course, the credit card companies can afford to pay rewards off the backs of folks like we used to be, who pay them interest.

Ouch!

Did we hurt your feelings when we said that? We didn’t mean to.

It’s just that we’ve been on both sides of the credit fence and it definitely feels better being on the “earning” side than the “paying” side when the credit card statement comes in.

As one astute speaker said, “Some people pay interest, others earn interest. Which are you?”

The Credit Cycle (Debt Trap)

We realize that some folks get caught up in a credit cycle, like a gerbil on one of those exercise wheels.

We realize that some folks get caught up in a credit cycle, like a gerbil on one of those exercise wheels.

They never seem to be able to stop, especially when it comes to buying Christmas gifts for their family.

You may be one of them. That’s why we’re writing this page: to help you.

Mint.com explains the seduction of using credit cards this way:

Spending money is easier with a credit card than with cash because you don’t feel like you’re spending money.

Individuals might be less likely to pay attention to how much they are spending or question their bill when using a credit card.

The Challenge

So, here’s the challenge (since this was originally written just weeks after Christmas 2010): we encourage you to make up your mind never again to have credit card statement shock by doing the following:

- Pay off all of your credit card debt as soon as possible. If you need it, perhaps you would like some goal setting help.

- Some people have been able to pay off the principal they owe more quickly by transferring credit card balances to a zero interest credit card.

- Vow that you will pay off any new credit card debt by the due date on your statements.

- The first month you cannot pay off the entire balance, arrange so that you cannot use the card until the balance is paid off. That way, you can’t compound the problem. (Some people cut up, microwave or bake their cards in the oven. That way the card is literally unusable and the source of temptation is removed. Of course, you still have to keep paying the bill.)

- Evaluate your spending, set up a budget (a spending guide) and stick to it with any flexibility you’ve built into it. (Did you know that even rich people need a budget?)

- Start to save up money toward certain purchases in advance, especially big ones.

- If your one big “splurge” is Christmas and you end up paying for it for the rest of the year, you may want to consider some clever alternatives.

- Some family members have agreed together that they will buy only one gift for a designated family member that costs no more than a certain amount.

- Or they may make something homemade with their own hands from items they already have on hand.

- Or they may repurpose an item into something that is really needed.

- Or they may agree to buy only good quality used items, such as you may find through consignment stores, thrift shops or an online auction.

- Or, if they have a cash back bonus type card, they may choose to give a gift card purchased with the bonus points.

Learn to Build Anticipation

Mike tells the story of how he saved up his driver loyalty or rewards points through a certain truck stop chain and waited to buy chrome until that chain was selling it at a significant discount.

Mike tells the story of how he saved up his driver loyalty or rewards points through a certain truck stop chain and waited to buy chrome until that chain was selling it at a significant discount.

Part of the excitement of making the purchase was the anticipation.

Unfortunately, most people don’t know much about building anticipation toward purchases these days because we feel that “we owe it to ourselves” (whatever “it” is) and that sense of instant gratification is stroked through the use of plastic as often as we want to swipe it across the point of sale machine.

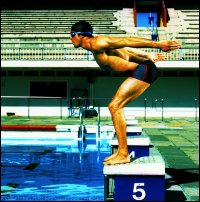

The swimmer pictured here is waiting for the right time to jump in the pool.

If he jumps in too early, he will disqualify himself. It’s a word picture that speaks volumes to us about proper timing.

When we force ourselves to wait for certain purchases:

- we get a better perspective on it;

- the likelihood of “buyer’s remorse” from making rash decisions will be greatly decreased; and

- there is no credit card statement shock because everything will have been carefully planned out.

Remember Your Obligations

A saying that we once read on Twitter went something like this: “The best way of saving money is to forget who you borrowed it from.”

Well, not only is that dishonest, but to just keep ignoring the credit card statements, eventually the creditors will demand payment.

By the way, for you to use a credit card, you have to agree to their terms and you become obligated to pay for whatever you spend using it.

You have to agree to terms when you enter into just about every financial contract, like making a truck payment.

You don’t want to run the risk of ruining your credit history or credit score, and you surely don’t want to risk repossession.

Trouble Paying Off Your Balance?

As a final thought, if you have trouble paying off your balance as soon as your credit card statement comes in, you may want to have a close friend hold you accountable for your spending decisions.

As a final thought, if you have trouble paying off your balance as soon as your credit card statement comes in, you may want to have a close friend hold you accountable for your spending decisions.

The use of credit is neither good nor bad.

The misuse of credit is the problem.

Mike says that, regrettably, the credit card statement shock he got was a hard lesson to learn.

Now he understands this principle: The borrower becomes the lender’s slave.

Being debt-free is extremely freeing.

We’re seeking to help you either get out of a money pit or never fall in.

Bear in mind this principle: Always spend less than you earn.

If you need help tracking your spending, you may want to use our spending diary (which is available through our free downloads page).

![]() Money saving tip: One of the most helpful things that Vicki ever did was to calculate in a spreadsheet how small regular deposits into a compound interest-bearing account would yield interest over time.

Money saving tip: One of the most helpful things that Vicki ever did was to calculate in a spreadsheet how small regular deposits into a compound interest-bearing account would yield interest over time.

You don’t have to do that because there are calculators online (like this one) that do the grunt work for you.

Also, she saw the wisdom of investing in commodities that had a history of appreciating in value over time.

Now, instead of paying a credit card company interest, it pays us in cash back rewards.

No more credit card statement shocks for us. Join us, won’t you?

Return from Credit Card Statement Shock: After Christmas and Any Time to our Budgeting page or our Truck Drivers Money Saving Tips home page.