Professional truck drivers may find themselves needing and obtaining cash via ATMs or Automated Teller Machines on the road.

What are the pros, cons and alternatives of using ATMs — especially if you are looking to save money?

What are the pros, cons and alternatives of using ATMs — especially if you are looking to save money?

An Overview of Paying for Transactions on the Road

Overall, these are among the most popular options by which professional drivers may pay for goods and services:

- cash (or cash advance),

- debit,

- credit, or

- ComCard or ComCheck.

Each of these payment options can be managed wisely or poorly.

One of the advantages of using cash only is that you can’t overspend. If you have nothing in your wallet, you can’t spend it.

The flip side to using cash is that if you have easy access to it, it can disappear quickly. That’s why we encourage budgeting and budget planning.

The flip side to using cash is that if you have easy access to it, it can disappear quickly. That’s why we encourage budgeting and budget planning.

We have only ever had one experience on the road where cash was rejected as a payment option: when we ran out of hours in Salt Lake City and wanted to tour the area, we rented a car for the day. The car rental agency insisted upon having a credit card.

Of course, individual preference may lead drivers to pay for truck-related or non-truck-related goods or services by certain means.

Some truckers keep a “truck fund” in their trucks which they use exclusively for truck-related expenses. They keep the truck fund separate from their regular personal expenses cash.

When either fund runs down, they replenish it. One source of replenishing cash is via ATMs or Automated Teller Machines.

Wikipedia defines automated teller machine (ATM) as “a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller.”(1)

The Pros of Getting Cash through ATMs

Although our society is growing increasingly more electronic, professional truck drivers sometimes face situations in the course of their work in which they must pay cash for products or services.

The most common cash-only expenses that professional drivers face are tolls and scale tickets.

For your convenience, we are listing the following resources:

- The Federal Highway Administration has on its website a list of Toll Facilities in the United States

- and the E-ZPass New York Center has on its website a Toll Facilities Participating in E-ZPass®.

Ever since the days when we drove as a husband and wife professional truck driving team, we have always preferred to use certified automated truck scales (or CAT scales) because of their guarantee. You will find the CAT Scale Locator online.

Some trucking companies provide the means to paying for these services other than by cash. For example, a company that Mike has driven for has E-ZPass transponders installed in their tractors so drivers don’t have to pay cash for tolls on those roads. Some drivers also pay for their scale tickets by ComCard or ComCheck.

Years ago, we recall having to pay a lumper in cash. Our memory is a little hazy on this, but we think that the highest cash price that we ever had to pay a lumper was $300.

We had to drive quite a distance away to truckstop to get the cash.

We had to drive quite a distance away to truckstop to get the cash.

Many lumpers now accept a ComCheck as payment, as long as it has the proper authorization numbers, allowing it to be cashed. If you pay a lumper with cash, make sure you get a receipt.

When Mike buys truck-related expenses – like paper towels, glass cleaner and faxes – with cash, he always gets a P.O. number from his company (no matter how small the purchase price was), to ensure reimbursement on his next paycheck.

Assuming that you have the type of account and card that allows you to use an automated teller machine, it is very easy to get cash in many places throughout the United States.

For your convenience, we are providing as a resource these lists:

The Cons of Getting Cash through ATMs

Some banks, bank accounts or debit cards may limit the amount of cash that you can withdraw from ATMs at any one time, or on any one day.

Some banks, bank accounts or debit cards may limit the amount of cash that you can withdraw from ATMs at any one time, or on any one day.

For example, our bank limits withdrawals to a maximum of $300 per day.

So, plan in advance in case you have an emergency repair of more than your maximum ATM withdrawal limit.

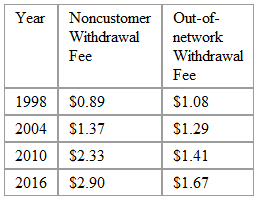

Before 1988, there were no fees for using ATMs. Now, some institutions charge fees for the use of their ATM machines either for all users or non-members exclusively.

Two types of ATM fees may be assessed:

- A “surcharge fee” is charged by the ATM owner to the customer.

- A “foreign fee” is charged by the card issuer to a non-network customer.(2)

The average surcharge for using ATMs has increased over time.

BankRate.com lists “Average ATM Fees” from 2016, from which you’ll see selected data here:

When both the surcharge fee and foreign fee are combined, one financial institution’s reported total withdrawal fee was as high as $11. (That’s per use!)

When both the surcharge fee and foreign fee are combined, one financial institution’s reported total withdrawal fee was as high as $11. (That’s per use!)

Some might argue that the banks deserve the fees since ATMs cost $9,000 to $15,000 each and annual maintenance cost is $12,000 to $15,000.(4)

However, a 2008 report by the Government Accountability Office found that banks’ non-interest income, which includes fees, rose to 27% in 2007.(5)

In our opinion, if there are less costly methods to getting cash, use those instead!

Using a Cash Advance Alternative to ATMs

When Mike needed a cash advance as a regional truck driver, he always tried to do so when he was getting fuel at a truckstop within his company’s network.

If he got a cash advance at a time other than when fueling, he had to absorb the fee.

When he was preparing to fuel his truck, he swiped his Comdata card on the fuel reader at the fuel island. (During the authorization process, one of the prompts regards getting a cash advance.)

He could get a cash advance up to the company’s pre-set limit by pressing in the dollar amount that he needed. After fueling, he got the cash at the fuel desk counter.

Different trucking companies handle cash advances against paychecks differently.

When Mike worked for Schneider, the driver was assessed a fee for cash advances, regardless of whether or not he got it while fueling!

One of the trucking companies Mike drove for limited the amount of money that drivers could get via cash advance.

One of the trucking companies Mike drove for limited the amount of money that drivers could get via cash advance.

If a driver needed more, he or she could get an override from his or her driver manager for the specific amount.

Also, the cash advance amount reset each Saturday at midnight. So if a driver maxed out one week, he could get more money by cash advance the next.

Be sure to check with your company’s policy, as it can differ from our experience.

Warning: We share on our site the personal knowledge of one driver who had very poor money management skills and cash-advanced his paycheck to death.

Note: We do not recommend getting cash via cash advance on any credit card, as the fees can be exorbitant.

Using the Cash Back Alternative to ATMs

Another way to get cash is to authorize cash back for an amount higher than the purchase price of an item at a store accepting debit card payments.

We have often done this at Wal-Mart and larger grocery stores.

Be aware, however, that the use of a debit card is only as good as the amount of money in the account from which it is drawn.

A debit card draws against a current account balance whereas a credit card has to be paid in the future.

To reduce fees even more, drivers can open free checking accounts.

Discuss with your banker the advantages and disadvantages of having overdraft protection on this type of account.

![]() Money saving tip: You can minimize or avoid ATM fees by:

Money saving tip: You can minimize or avoid ATM fees by:

- banking with a financial institution that charges no surcharge fee to customers or that refunds surcharges;

- using your own bank’s ATM network exclusively;

- getting cash bank on purchases paid by debit card; or

- getting a cash advance on your paycheck when fueling, through a company that will not charge a fee for doing so.

Return from ATMs: Pros, Cons and Alternatives of Automated Teller Machines to our Truck Driver Budgeting page or our Truck Drivers Money Saving Tips home page.

References:

1. http://en.wikipedia.org/wiki/Automated_Teller_Machine

2. http://en.wikipedia.org/wiki/ATM_fee

3. http://www.bankrate.com/brm/news/chk/chkstudy/20081027-ATM-fees-a1.asp

4. http://money.cnn.com/2007/09/17/pf/raw_deals_atm/index.htm

5. http://articles.latimes.com/2008/oct/28/business/fi-bankfees28