When we read USA Today’s 2011 article about pay-by-the-mile (or pay per mile) car taxes, we immediately saw both the bad and the good for truckers.

content.usatoday.com/communities/driveon/post/2011/08/more-states-considering-pay-by-the-mile-taxes/1 (no longer online)

Although this issue involves how one form of taxes could be paid, we draw a direct line to an improved way of how truckers could be paid.

Although this issue involves how one form of taxes could be paid, we draw a direct line to an improved way of how truckers could be paid.

Pay Per Mile: Tracking a Truck and its Driver

As anyone who has been involved in trucking knows that commercial motor vehicles have had to become more technologically advanced over time.

In 2012, MAP-21 (the federal highway bill passed into law) mandated EOBRs (electronic on-board recorders, also known as “e-logs” or electronic log books) in Sec. 32301.

In 2017, there was a mandate for every truck with an engine newer than 2000 to have an Electronic Logging Device (ELD) in place.

Professional truck drivers are split on this issue.

But the point remains that ELDs track every mile that a truck travels.

Pay Per Mile: Viewpoint: Liberty

From a liberty point of view, we don’t like the idea of being tracked.

But there have been times when it has come (or, in the future, might come) in very handy.

- Many trucks are already outfitted with a satellite communication system (such as QualComm) that allows drivers to communicate with folks inside a trucking company on a variety of issues. We have already covered the issue of drivers electronically documenting their arrival at shippers and receivers so that they can get waiting time pay when they are delayed.

- When Mike was driving OTR and needed to connect with another driver to arrange a repowered load (a swap of trailers so that the product on board could reach its destination on time), the driver manager’s ability to “see” the other driver’s location and estimate his/her arrival at the proposed meeting place was very helpful.

- If there was ever a hi-jacking or attempted robbery, the satellite communication device would be able to record the truck’s location and/or movement.

- Some trucking companies have also installed tracking devices on their trailers to better manage them. Have you ever been told to go to a particular drop yard to look for a trailer that was “supposed” to be there (according to the company’s information) but had already been moved? It’s frustrating and it wastes time that you could have been paid rolling down the road.

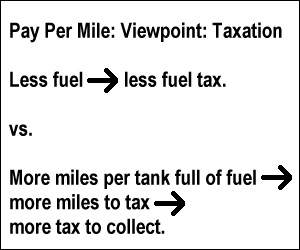

Pay Per Mile: Viewpoint: Taxation

From a taxation point of view, lawmakers salivate over the thought of an untapped market for collecting taxes — especially as vehicles become more fuel efficient and therefore use less fuel.

An overview of the difference between the fuel tax (paid on every gallon of fuel) and pay per mile tax (paid on every mile traveled) might look like this:

There are pros and cons to both.

Personally, we feel that the government:

– already takes too much in taxes; and

– doesn’t wisely spend the money it collects.

But that’s a subject for another time.

Another wrinkle regarding collecting taxes on every gallon of diesel used by trucks is that quite a number of fleets have begun making the switch to being powered by natural gas.

In May 2012, TruckingInfo.com addressed the fact that Taxing Natural Gas Trucks Will Pose a Challenge.

As more and more vehicles become powered by electricity or alternative fuels, the greater the push will become to switch from one form of taxation to the other.

We do not know how moving to a pay per mile taxation system could affect proposed increases in road tolls.

We need to issue two words of warning about going to this new form of taxation:

- What happens if the new tax is implemented before the old one is phased out? There could effectively be double taxation.

- What happens if a progressive taxation system is put in place? Elected officials would not be able to resist raising taxes whenever it struck their fancy to do so.

Pay Per Mile: One Advantage: Driver Pay Increase?

One advantage (perhaps the only one we can think of) to trucks being taxed on a pay per mile basis is a weakening of the argument that trucking companies, shippers and receivers use to pay drivers according to miles as recorded in the Household Movers Guide (HMG) or Household Goods (HHG) Guide.

Let’s delve into this a little deeper…

- According to this thread on Truckers Report Trucking Forum, there can be a big difference between HMG miles and practical miles.”MadMac” (a trucker with 18 years experience) wrote,

“Practical miles are generally the best route, interstate or major highway. HMG is the SHORTEST way possible, taking every known road, to get the shortest. Some may not be truck routes.”

- A posting on a website said of the trucking jobs for the company: “Mileage pay is based on Rand McNally Household Movers Guide Dispatch Miles.”(1)

- A 20-year trucking veteran wrote:

“Rand McNally helped create the first issue of the household movers guide in 1936. It was created to provide uniformity in the charges trucking companies (specifically household movers) were quoting their customers based upon weights and distances. The guide used criteria such as the height, width, and lane width restrictions to formulate the shortest possible distance between the towns or cities.

Many drivers state there is a 5 to 10% variance in the pay mileage and the actual mileage a trip actually pays. …”

- “Truckerjo” provided the definitions for Air Miles, Mover Miles, Practical Miles, Short Route Miles, Hub Miles and Out of Route Miles.

Pay Per Mile: Where in the City is That Location?

For years, professional truck drivers have railed against being paid on a cents-per-mile basis for less miles than they actually have to travel to pick up and deliver freight.

It is the “industry standard,” we have been told.

A personal example of this was when Mike drove for a certain OTR trucking company that had contracts with Lowe’s Home Improvement stores.

Since the trucking company was headquartered in North Carolina, they naturally had runs going to and coming out of the Olin, NC, Lowe’s facility north of Statesville, NC.

According to reports Mike heard, Olin was later incorporated into Statesville.

How did this affect his pay?

Invariably, Mike would get a load coming from the south into the Olin facility north of Statesville. If Google Maps is correct, the distance between the two is between 13 and 16 miles, depending on route.

If one multiples 15 miles times a rate of, say, 35 cents per mile, that’s $5.25.

Granted, it isn’t much, but if the situation happens over and over again, that “ding” can really add up.

For reference purposes, here is the link for Rand McNally maps online.

We visited the site and typed in Olin, NC, and Statesville, NC. Their own online map says that the distance between the two is 15.0 miles!

There are many such disparities.

There are many such disparities.

Another example is the exits on I-10 connecting with I-610 around Houston, Texas.

They are at mile markers 763 (West) and 775 (East), a difference of about 12 miles.

Drivers who have to pick up on the “far” side of the city may be getting shortchanged each and every time they transport freight in that area.

If trucks were taxed on a pay per mile basis, somewhere the documentation would be in place for truckers to be paid on the same basis.

Pay Per Mile: Follow the Money Trail

There’s an old saying: “Follow the money trail.”

There’s an old saying: “Follow the money trail.”

We are therefore compelled to ask:

Just who is it that stands to benefit from paying drivers based on an antiquated system when so much of our technology has GPS (global positioning systems) included?

If trucking companies had any backbone, they would start banding together to demand that shippers and receivers pay for the movement of freight based on actual or practical miles (the ones that truckers have to use, truck routes and all).

This would not only help the drivers but help them!

Think of all of the miles that the equipment has to cover that aren’t being paid for per mile — unless, of course, there is an insider “double standard” in which the company gets paid for all the miles but the truckers get shortchanged based on HMG!

That discovery, if it exists, would really make truckers angry!

Pay Per Mile: Does It Affect The Trucker Shortage?

In July 2012, multiple news reports surfaced about how there are many truck driving jobs that are going unfilled.

In July 2012, multiple news reports surfaced about how there are many truck driving jobs that are going unfilled.

It is highly reasonable to suppose that potential drivers are staying away from the industry — and those who have left the industry refuse to come back — because of just such pay per mile “cheating” going on.

One could argue that if a trucker agrees to be paid on the basis of HMG, he/she is not being cheated at all.

If there is full disclosure, there is no ground for complaint. (This is one of the questions to ask a recruiter before being hired.)

Still, if professional truck drivers are entrusted with the movement of hundreds of thousands of dollars worth of freight, each driving an expensive rig, they should be paid accordingly.

Although we in no way encourage a trucker protest, we think that now that the ELD mandate is in place, the time is right for an industry-wide change regarding the pay per mile basis upon which drivers are paid.

Other articles on this subject include:

Pay Per Mile: Feedback Wanted

As you may know, we have only ever driven professionally as company drivers.

We understand this issue from that perspective.

We would like to hear from owner-operators about this.

Where do you stand on this issue?

Please speak out through the form on our Truck Operations page.

![]() Money saving tip: From a liberty point of view, we do not like the idea of being tracked.

Money saving tip: From a liberty point of view, we do not like the idea of being tracked.

However, every truck that has a satellite communication system in it is already being tracked.

The same thing applies to every driver who uses a phone with a GPS system in it.

We encourage drivers to keep a written record of their paid miles versus their actual miles each and every time they haul a load.

Only by documenting the difference and speaking out about it will change get made.

Remember: The less money you are paid, the less money you have to save. If you’re doing the work, shouldn’t you get paid for all the work you do?

If you feel strongly about this matter, you may begin to speak out:

- to your trucking company,

- within social media, and/or

- to your elected officials.

Return from Pay Per Mile: One View of Pay-By-The-Mile Taxes for Truckers to our Truck Operations page or our Truck Drivers Money Saving Tips home page.

Reference:

1. www.truckersdispatch.com/company/swift_transportation.php/31/ (no longer online)