Direct deposit is basically an authorized electronic transfer of your paycheck from your employer to your bank account.

This service is very valuable to many people, especially professional truck drivers who are on the road for days, weeks or months at a time and may not be in their home area to take care of banking needs.

This service is very valuable to many people, especially professional truck drivers who are on the road for days, weeks or months at a time and may not be in their home area to take care of banking needs.

Since the transfer is electronic and not physical, there is

- no paper check cut,

- no check mailed (or lost in the mail or stolen),

- no need for you to take physical possession of a piece of paper,

- no need to take your check to the bank for deposit or cashing, and

- no delay on getting your money.

It is even helpful to drivers whose home support teams could take care of these things for them.

Some people also use this service to receive Social Security checks and income tax refunds.

Some people also use this service to receive Social Security checks and income tax refunds.

It is touted as being secure, convenient and fast.

There is no cost that we are aware of for employees to have this service.

The National Federation of Independent Business had at one time listed on their website the “Costs and Benefits of Direct Deposit of Salary Checks.”

nfib.com/content/resources/money/costs-and-benefits-of-direct-deposit-of-salary-checks-19045/ (no longer online)

At the time this page was first written, they stated that an estimated 60 percent of United States employees use this service.

Savings for Whom?

Of course, in the process of saving employees money, it would also be nice if this service helped employers save money, too.

In 2009, ElectronicPayments.org had this to say:

“According to a calculation of the costs of paper checks vs. Direct Deposit payments, a company with 100 employees can save nearly $19,000 per year by switching to Direct Deposit, whereas a large business of 30,000 employees could realize over $5.7 million in annual cost savings.”

They also listed savings of both cost and time for businesses with fewer than 10 employees that switch to this service.

Focusing closer to home, how does this work specifically for the trucking industry?

Trucking companies that do not yet offer direct deposit need to realize the multiple advantages of this service and offer it as an employee benefit.

Trucking companies that do not yet offer direct deposit need to realize the multiple advantages of this service and offer it as an employee benefit.

Perhaps when trucking companies that do not prominently post on their websites the availability of this service to employees realize its importance to potential employees, they will do so.

Besides all of the advantages listed above, actual cost savings for truck drivers come into play when banks offer free checking (that is, no monthly service charges) for account holders who have direct deposit.

You may wish to Google the phrase “direct deposit to avoid bank service charges” and to find banks that offer this cost savings.

How Monthly Service Charges Add Up

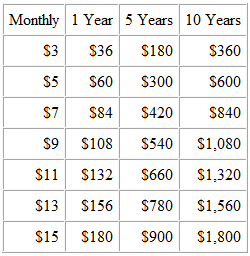

What may seem like a “small cost of doing business” by paying a monthly service charge to the bank is money that you could be saving but is seemingly going down the drain!

Let’s take a look at potential (although not necessarily actual) monthly service charges and get a 1-year, 5-year and 10-year overview of the costs:

Disadvantages of Direct Deposit

It can be a hassle to change your authorization of depositing your check into a new bank account, so make sure that if you plan to change banks that you leave plenty of time for the transfer and any new authorization to take effect.

One trucking company that Mike used to drive for advised its drivers to allow up to three weeks for any changes to a direct deposit authorization to take effect.

As an alternative to having this service, this company offered drivers the opportunity to have their paychecks loaded to their company-issued Comdata cards so that they can get their money any time they need it.

Of course, you will want to keep enough cash with you in case there are any bank issues.

Once when we were driving for U.S. Xpress, we had a problem with a paycheck being directly deposited into our checking account.

Once when we were driving for U.S. Xpress, we had a problem with a paycheck being directly deposited into our checking account.

We had not been on the service for very long.

Being team drivers and not having Internet access on the road back in the early 1990s, we made the erroneous assumption that the check had been deposited in our account on the target date, at which point we began writing checks on the “new” account balance.

Oops!

We did some checking.

The trucking company claimed that they wired it but our bank claimed that they never got it!

We wracked up some service fees for being “overdrawn,” but when the bank ended up getting the money (why it was delayed we don’t know), they dropped all the service fees.

Since we didn’t even have cell phones back then, all of the chasing down of the problem was very inconvenient when we didn’t come home but once a month.

Since we didn’t even have cell phones back then, all of the chasing down of the problem was very inconvenient when we didn’t come home but once a month.

So our advice based on this all-too-painful event in our lives is to make sure that you always have enough cash in your account before your start writing checks on the new deposit.

Don’t count on a check being in your account until you have proof.

Many banks now have accounts that are Internet accessible, which is one way of checking on account balances.

For more help on keeping up with spending and saving, we refer you to our budgeting page.

![]() Money saving tip: Although there may be specific circumstances in which directly depositing your paycheck directly into your bank account may not be right for you, having direct deposit service can help people in many ways that add up to cost savings.

Money saving tip: Although there may be specific circumstances in which directly depositing your paycheck directly into your bank account may not be right for you, having direct deposit service can help people in many ways that add up to cost savings.

One of them is enabling people to get “free” checking accounts at some banks, meaning that they do not have to pay monthly service charges or fees to use the service.

Evaluate all of the options at your disposal among banks with which you are likely to do business.

It is possible that a particular type of account that does not have direct deposit works better for you for some reason.

For example, if a type of checking account pays interest on the balance but does not allow for electronic deposits, the amount of interest may be worth it to you.

It is up to you to decide which benefits you like best.

Return from Truckers Using Direct Deposit as a Means of Saving Money to our Employee Benefits page or our Truck Drivers Money Saving Tips home page.